Disrupt or Be Disrupted: How Value Decoupling is Changing the Game

In today’s rapidly evolving business landscape, value decoupling has emerged as a critical challenge, particularly for established companies facing disruption. This phenomenon occurs when competitors—often digital disruptors—strategically peel away key customer activities, eroding the foundation of traditional business models. In this discussion, we will explore the forces driving decoupling, the strategies digital disruptors use to separate and capture customer interactions, and real-world examples of companies that have suffered as a result. We will also delve into why digital players are often better positioned to leverage this strategy, the common missteps traditional businesses make in response, and the approaches they can adopt to counteract these threats and retain their competitive edge. Finally, we will examine future trends, identifying industries most vulnerable to decoupling and the role AI and automation may play in accelerating this shift.

To gain deeper insights into how value decoupling shapes business disruption, we spoke with Professor Thales S. Teixeira, co-founder of Decoupling.co and author of Unlocking the Customer Value Chain: How Decoupling Drives Consumer Disruption. Professor Teixeira, who is also a Professor of Practice – The University of California, Harvard Digital Initiative and a Judge at CNBC Disruptors 50, shared expert perspectives on navigating this evolving landscape.

Co-founder – Decoupling.co

Photo: Professor Thales S. Teixeira

Understanding Value Decoupling

What is Value Decoupling? How Does it Drive Business Disruption?

Decoupling refers to the process by which startups or digital players separate specific activities within the customer value chain that were traditionally offered together by incumbent companies. This allows these disruptors to focus on and capture one or a few particular customer activities, often leading to significant shifts in market dynamics. For instance, Uber decoupled calling for or hailing taxis. Netflix decoupled away the need to go to the movie rental store. Fintechs such as PayPal, NuBank and Rocket decoupled away online payments, credit card applications and mortgages away from big banks.

By isolating and delivering these specific activities, digital disruptors can deliver much higher value to consumers, often at a lower cost or with greater convenience, thereby challenging established businesses.

What Key Forces Are Accelerating Business Decoupling Today?

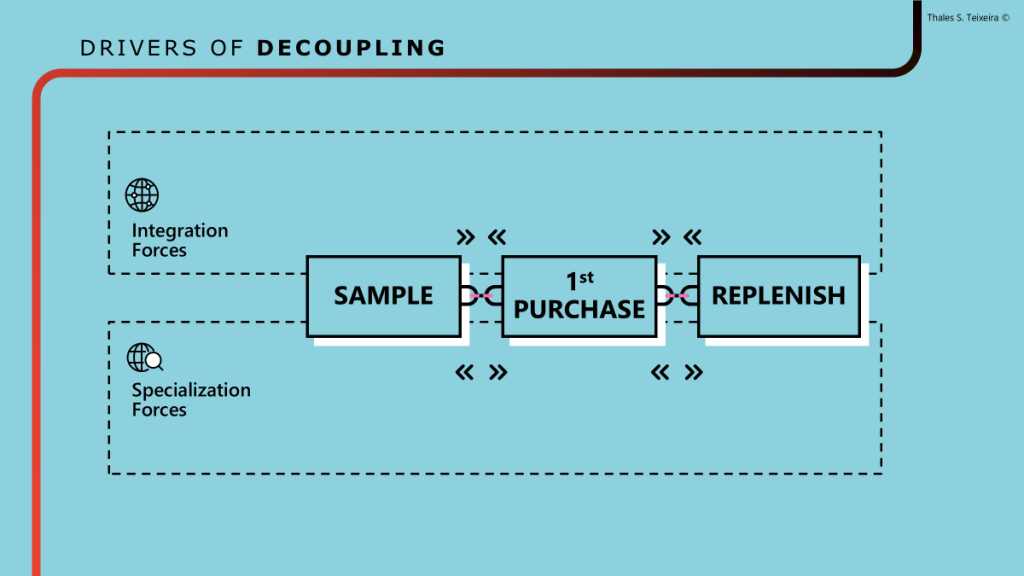

Decoupling is a particular class of specialization in business. By decoupling, consumers implicitly say “I want to work with three or four different fintechs that are specialized in different parts of my value chain than work with one integrated bank that does everything.” In beauty, consumers have started using beauty box subscription businesses to sample products at home. Why? It is more convenient. Then they often search online and buy on Amazon. Why? It’s sometimes cheaper. And they use an online delivery service that constantly replenishes their cream or make-up because it provides assurance. Consumers are driven to decouple by these so-called Specialization Forces at the same time that they might be pushed to adopt a one-stop-shop like Sephora due to counteracting integration forces.

Impact on Established Businesses

How Do Digital Disruptors Successfully Separate and Capture Customer Activities?

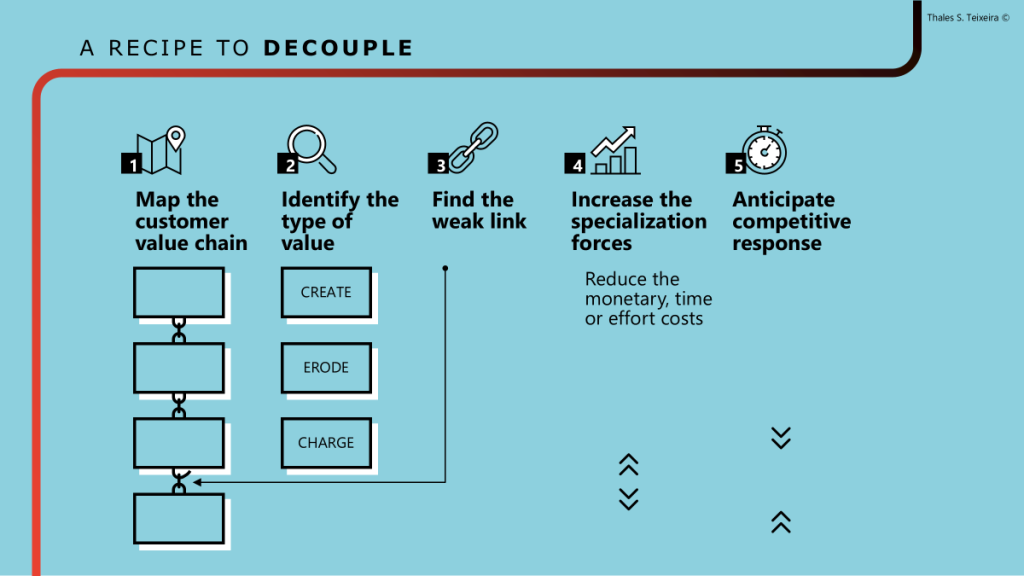

In my book, Unlocking the Customer Value Chain, I show how there is a so-called ‘recipe for decoupling’ in that there are logical steps to follow and ingredients to use. Not that it guarantees success. Start off with mapping the customer value chain, then identify each activity as value creating, eroding or capturing (Note; there can be only one of each in each stage.) Find where customers are collectivity unhappy with the activity. For instance, returning a movie to Blockbuster or trying to go out on the street to find a taxi. That is what I call a weak link. Then the way to peel off that activity or decouple it is most easily accomplished by making it cheaper, faster or easier for the customer to do that activity. And lastly, anticipate the competitive response of the company that is about to lose that activity decoupled away.

Which Type of Businesses Are Struggling Due to Decoupling?

Physical retailers around the world have seen their stores become showrooms. People go to the store to learn what to buy then they go home and shop online. The store is being used for product discovery and testing. That is decoupling and Amazon was one of the first e-retailers to learn about this and then incentivize their consumers to go to stores and then search on their website. In a different context but similar manner, telecom companies have lost international calling to the Skypes and WhatsApps of the world, banks have lost financial products shoppers to online aggregators such as LendingTree and CreditKarma. In virtually all industries I looked at, I saw what is fundamentally the same phenomenon: it is decoupling at work.

What Critical Mistakes Do Traditional Businesses Make in the Face of Decoupling?

The biggest mistake when traditional companies start seeing their businesses suffer from disruptors is to try to mount a response to the disruptor itself. They think that their business model is under attach because of the disruptor. No. The customer is the disruptor. Startups are just waiters “quick to serve” their patrons as fast as they ask and only what they ask for. So, incumbents need to respond to the rise of decoupling, not engage in a price war, try to buy or put the startup out of business. Even if they succeed, there will come another one. Banks tried to fight PayPal more than 25 years ago. What happened? Venmo happened. Then Square, and Stripe and Toast. They should have realized that people want a fast and low (no) cost way to transfer small amounts of money conveniently.

What Gives Digital Players an Edge in Decoupling?

Digital companies inherently hold advantages in agility, lower operational costs, and better data-driven insights. Big companies are making too many dishes (or products) in the kitchen, and for too many people. They are bound to burn a dish here or there. It’s inevitable. That creates customer dissatisfaction. On the other hand, startups begin their disruptive journey with one dish, one product. Their goal is to perfect it and decouple. They are focused, they are fast, and they know that they will die if they don’t get that dish perfect. So, who wins? Those that execute with perfection, despite having less money, people and resources than the established companies.

How Can Established Companies Detect and Address Vulnerabilities Before Disruption?

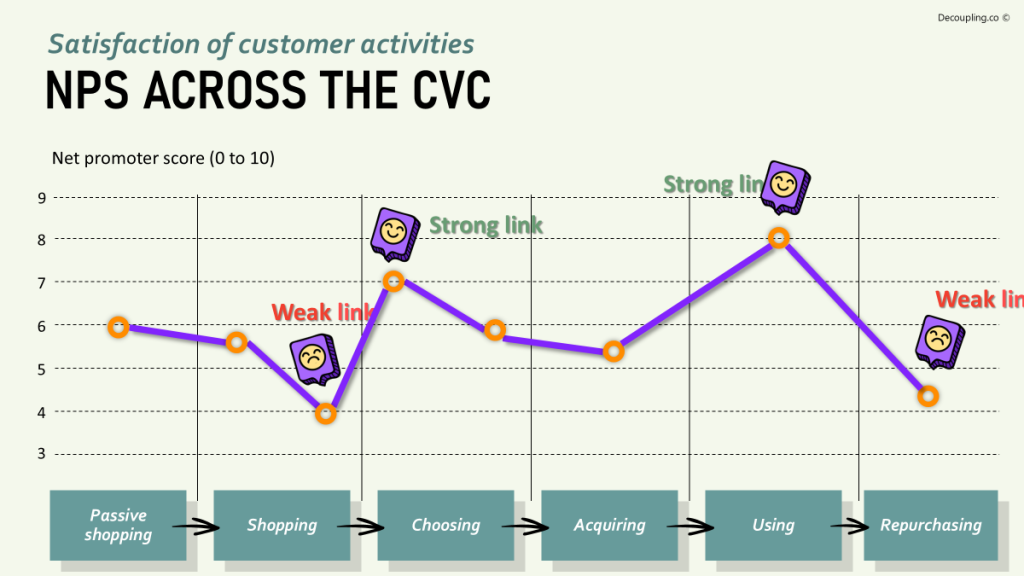

They need to understand which, out of all the activities in their customers value chain, are the weak links. My company, Deocoupling.co uses a combination of online reviews and surveys, all collected and compiled with AI to capture the Net Promoter Score or satisfaction for all the activities done by our client to their customers. Having done this dozens of times, I can say with confidence: all established companies have strong links and weak links. That is a given. What separated the disrupted from the survivors is how quickly they identify and fix their weaknesses.

How Can Businesses Counteract Decoupling and Retain Customers?

After identifying the weak links of the business, always using a customer-centric approach, then it is time to understand why customers are dissatisfied. Then things can go in one of many directions. It could be a product problem, a business model problem, a channel conflict problem, to name a few. Here, better data and analytics help to diagnose the problem to its core root. And then, it is a matter of innovating to improve satisfaction with that activity. If this occurs, you are in effect, reducing the motivation for your current customers to leave you and try out their luck by taking a risk with a new startup. People forget this. Early adopters of Amazon, Uber and Airbnb took great risk at a time when you could not get the book you ordered, you could be attacked by your driver at night, or something worse could happen as you slept next door to the owner of the apartment. They took this risk because they were unhappy with the available alternatives. Or the bookstore, taxi or hotel was purely not available for them.

Future Trends and Implications

Which Industries Face the Greatest Risk of Decoupling in the Near Future?

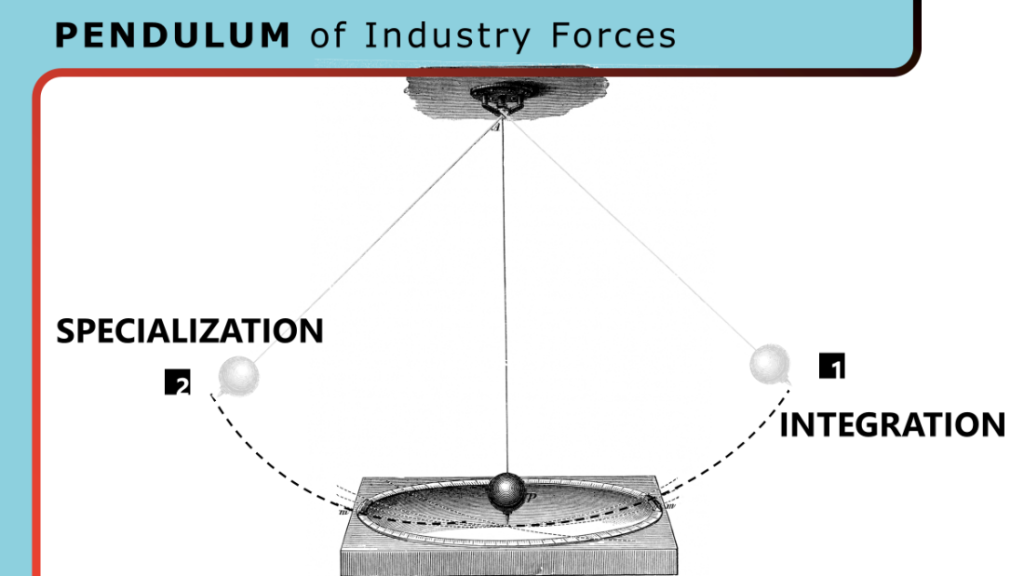

I see the various industries in the world as either trending towards more specialization, via decoupling. In this case are retailing, banking, restaurants, education, etc. Or the industry is pending towards integration as excessive specialization occurred in the past. Here, agribusiness is a typical case. Farmers are forced to deal with dozens and dozens of vendors. This is complex and chaotic. They would prefer to deal with a one-stop shop. And that seems to be a direction for the pendulum in their industry. Whatever the direction, more integration or more specialization, you need to know that for the industry in which you operate.

How Will AI and Automation Speed Up Business Decoupling?

AI and automation are powerful accelerators of decoupling by significantly enhancing the efficiency, personalization, and predictive capability of customer interactions. These technologies allow disruptors to identify valuable customer segments, automate interactions previously controlled by incumbents, and provide unprecedented convenience, thus hastening the shift of control away from established players toward nimble, digitally savvy competitors. In short, I expect AI to significantly accelerate decoupling in the vast majority of industries in the coming years.

To learn more, watch this short Master Class by Prof Teixeira: First Lesson Taught in Harvard MBA in 18 Minutes

Stay ahead with exclusive insights! Sign up for our mailing list and never miss an article. Be the first to discover inspiring stories, valuable insights and expert tips – straight to your inbox!