It’s Time to Challenge the Status Quo

How often have you sent an invoice, only to find out later that it was lost in a cluttered inbox or ended up in spam? How many times have you had to chase your clients or suppliers to confirm they received your invoice? Have you encountered issues with missing or incorrect invoice details after manually entering information into your system? Have you faced delays in payments because of slow processing and approval times?

If these issues sound familiar, it’s time to reconsider how you handle invoicing. While PDF invoices have been the norm, they come with inefficiencies that slow down your operations, delay payments, and increase the risk of human errors. PDF invoices may be familiar and “good enough” for now, but in a global economy, sticking to outdated methods will place your business at a disadvantage. Luckily, there’s a better way forward. That’s where e-invoicing — such as InvoiceNow — steps in to transform the invoicing process, eliminating these barriers and unlocking greater business potential. This transition is not simply about efficiency, it will position your business as forward-thinking, digitally capable, and easy to work with. It enhances your credibility, proving that your business is aligned with global best practices and able to meet the expectations of digitally savvy customers and suppliers.

What is InvoiceNow? Why Does It Matter?

1InvoiceNow is Singapore’s national e-invoicing network, introduced by the Infocomm Media Development Authority (IMDA) in 2019. It enables businesses to send e-invoices system-to-system, which means there is no need for PDFs or email attachments. This direct transmission between finance systems eliminates the need for manual processing and accelerates payment cycles. It uses the Pan-European Public Procurement On-Line (PEPPOL) network, a secure and internationally recognised framework that ensures invoices are delivered accurately and instantly. It offers an intelligent solution to address common pain points with PDF invoices.

In Singapore, the government has taken a strong lead in driving this shift. The government supports InvoiceNow for vendor payments across the public sector. This ensures secure, more reliable transactions with government agencies and signals a clear shift toward nationwide adoption. Businesses across industries are following suit as they recognise that e-invoicing improves efficiency and enhances professionalism. 2From May 2025, GST-registered businesses are encouraged to begin using InvoiceNow solutions to send invoice data directly to Inland Revenue Authority of Singapore (IRAS). This begins with voluntary early adoption and will set the stage for future compliance. By connecting directly to IRAS, businesses benefit from simplified operations, faster GST refunds and automatic alerts if charged incorrectly. The system allows IRAS to resolve issues quickly and with less disruption to your operations. As support continues to grow across both public and private sectors, InvoiceNow is becoming Singapore’s national invoicing standard.

5 Key Differences: PDF vs InvoiceNow

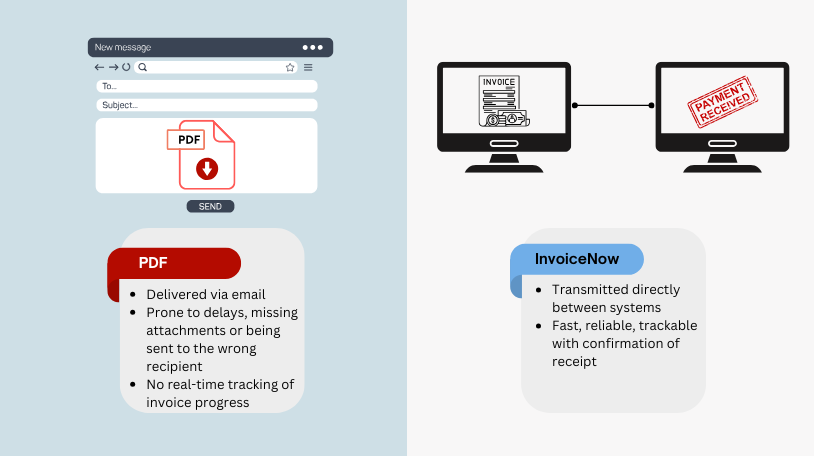

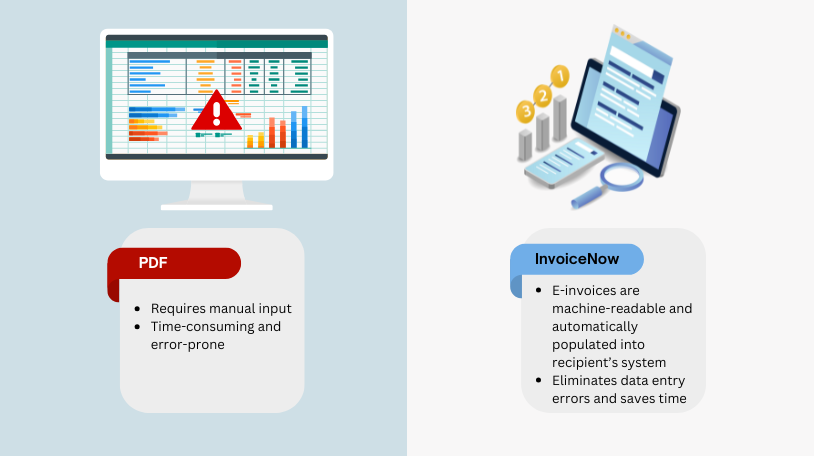

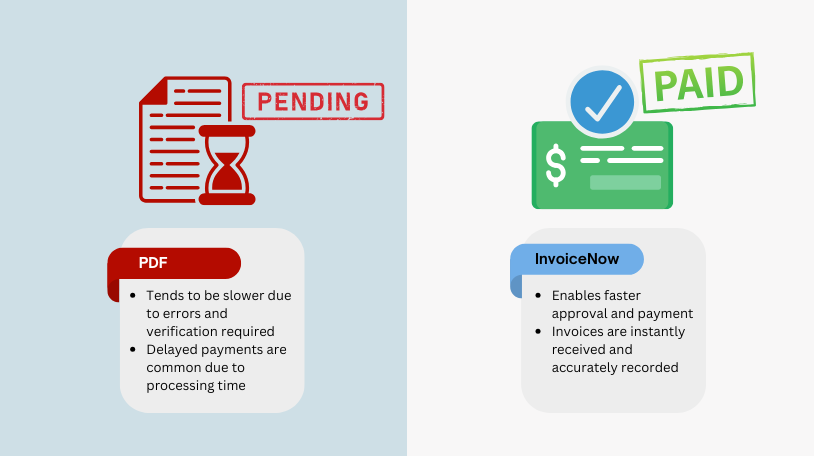

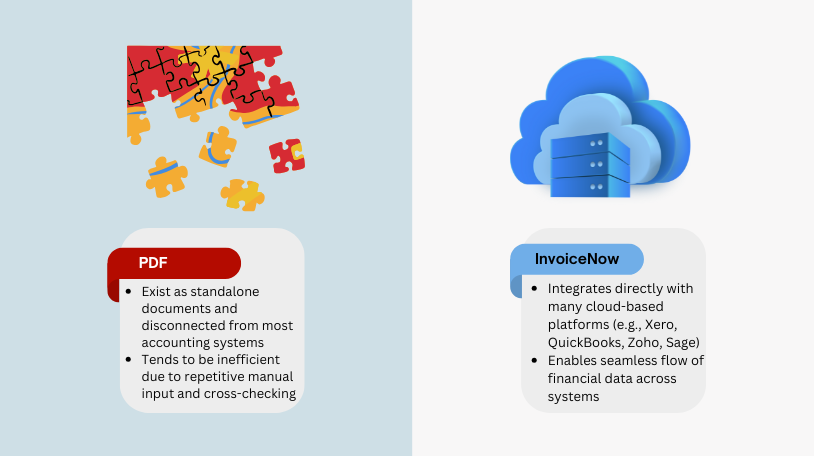

PDF invoices have long been the default for many businesses – easy to create, simple to send, and widely accepted. However, for companies aiming to modernise their operations and speed up payments, InvoiceNow facilitates secure, machine-readable invoicing between systems. This means no more missing file attachments, no more repeated follow-ups, and no more frustrating delays. Here are the key differences between PDF invoicing and InvoiceNow that businesses in Singapore need to understand.

1. Delivery

2. Data Entry

3. Payment Speed

4. Scalability

5. Integration

What’s Holding You Back? Getting Started is Easier Than You Think

Transitioning to InvoiceNow is straightforward when approached methodically. First, businesses need to understand what InvoiceNow is and how it can streamline invoicing operations. It’s crucial that key stakeholders in finance, operations, and IT are on the same page. Begin by evaluating your current invoicing workflows and assessing whether your existing accounting software supports Peppol-based e-invoicing. Many cloud-based accounting tools, such as Xero, QuickBooks and Zoho, are compatible with InvoiceNow. If your system supports it, simply enable the feature and proceed to register your business on the Singapore Peppol directory to start sending and receiving structured e-invoices.

If your current accounting system doesn’t support InvoiceNow, you can work with an IMDA-accredited service provider to integrate it with your existing infrastructure. These providers can help connect your system to the Peppol network securely and efficiently. Registration on the Peppol network is a key step, as it allows you to exchange e-invoices with local and international partners. The registration process is straightforward, typically involving the submission of business details and the integration of your system with the Peppol framework.

Once your system is set up, it’s important to inform your clients and suppliers about the shift to e-invoicing. To make things easier, start with those who are already using e-invoicing or working with government agencies, as they are more likely to be receptive. You can gradually phase out PDF invoices, allowing both formats (PDF and InvoiceNow) to coexist in the early stages of implementation. This approach ensures a smooth transition, giving clients and suppliers time to adjust and make the switch when they are ready. Over time, as more businesses adopt e-invoicing, you can fully embrace InvoiceNow, driving efficiency and reducing administrative overhead in your invoicing processes.

Conclusion: Step Into The Future with InvoiceNow

As Singapore accelerates its move towards a digital-first economy, initiatives like InvoiceNow play a crucial role in helping local businesses. For SMEs, e-invoicing provides a powerful opportunity to work efficiently, eliminate bottlenecks, and stay competitive in a complex business environment. By transitioning to InvoiceNow, businesses can cut down on manual tasks and gain real-time insight, while reducing the risk of errors.

Most importantly, e-invoicing positions businesses to thrive in an increasingly interconnected world. InvoiceNow allows your business to connect more easily with global partners—especially in regions like Europe, where e-invoicing is now mandatory in many countries. Businesses that choose not to adopt e-invoicing risk being left behind and unable to compete with counterparts that have streamlined their processes. InvoiceNow offers an opportunity to align with this global shift and future-proof your operations. With such smart systems in place, you can shift your focus from manual tasks to driving growth and innovation. The shift to e-invoicing has begun, it’s time to move forward with confidence and position your business to lead.

For more information on implementing InvoiceNow, visit the IMDA website.

Stay ahead with exclusive insights! Sign up for our mailing list and never miss an article. Be the first to discover inspiring stories, valuable insights and expert tips – straight to your inbox!

- “Get your business future-ready with InvoiceNow” imda.gov.sg https://file.go.gov.sg/invoicenow-brochure-2025.pdf (accessed 13 May 2025) ↩︎

- “Prepare early and adopt the GST InvoiceNow Requirement from 1 May 2025” iras.gov.sg https://www.iras.gov.sg/who-we-are/what-we-do/annual-reports-and-publications/taxbytes-iras/gst/prepare-early-and-adopt-the-gst-invoicenow-requirement-from-1-may-2025 (accessed 13 May 2025) ↩︎