What Happens When Two Founders Start a Business With No Clear Rules?

Every entrepreneur begins their journey with a good idea, a trusted friend, a shared dream. It always starts with, “We should do something together.” The idea feels fresh, the energy is high, and the possibilities seem endless. Those first moments are filled with hope and optimism, where everyone is enthusiastic, the roles seem obvious and collaboration feels smooth.

This is the classic startup story of two friends chasing a dream and finally deciding to make it happen. Party A and Party B were exactly like this: Friends with complementary skills, united by a vision, and eager to launch their business. They set things up quickly, registered the company, gathered support, and celebrated those first sales with all the excitement of a fresh startup. Like many founders today, they were energised by the momentum but one crucial step was overlooked: They never discussed, let alone drafted, a shareholders’ agreement.

At the start, founders often underestimate the need for these agreements and frameworks. They trust each other and want to focus on growing the business, assuming their friendship and goodwill will carry them through. They never imagined they would disagree or fall out. Administrative formalities seem like a distant concern. Drafting agreements were deemed to be unnecessary and costly, so it got postponed or ignored.

Yet, once important decisions need to be made and the paperwork and responsibilities start piling up, the reality of starting your own business becomes far more complex. What once felt simple now requires structure. Many founders realise that without the right foundations in place, even the strongest relationships or the most promising ventures can quickly drift off course.

As businesses starts to grow, priorities may start to differ. Party A believes money should be reinvested to fuel expansion, while Party B wants to withdraw dividends to enjoy the rewards of their hard work. Party A pushes to hire aggressively and scale fast, while Party B worries about cash flow and prefers a cautious approach. What was an easy collaboration has now turned into daily debates, with every decision sparking disagreement.

Why Do Founder Conflicts Happen

Founder conflicts often happen when businesses start without clear rules. Initially, partners rely on goodwill and friendship, believing that trust will carry them through. Business formalities demand structure and accountability, yet personal relationships can clash with these obligations.

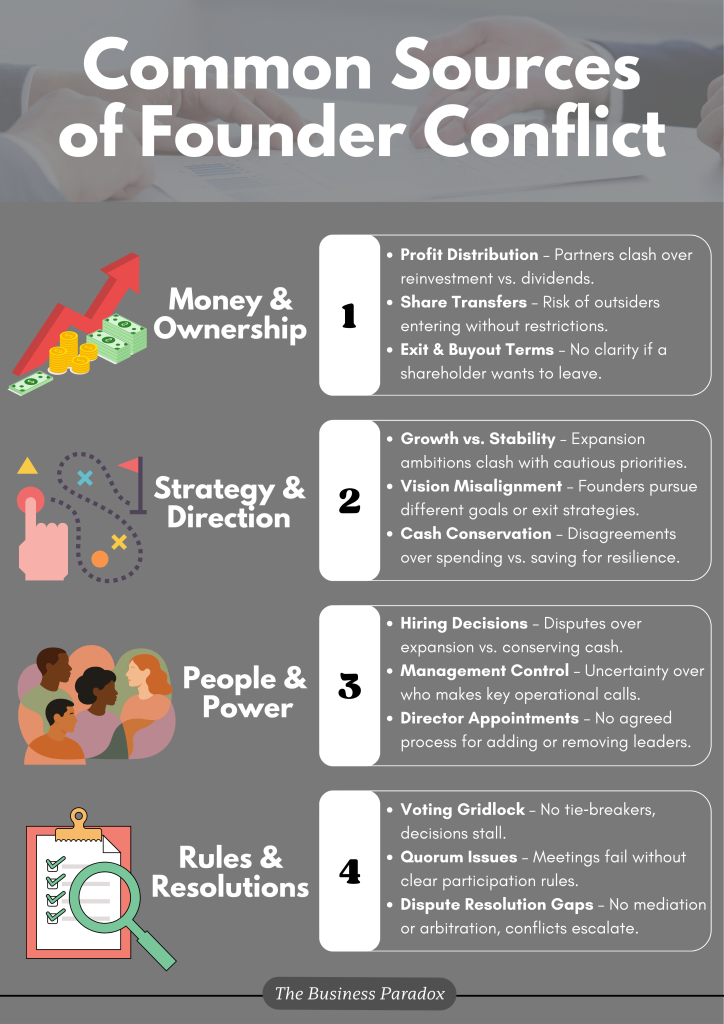

Conflicts like these are common: Do they reinvest or take profits? Expand the team or stay lean? Push for growth or prioritise stability? Without any written clarity, roles start to blur. Who has the final say? How are profits distributed? Who takes on the liability? What if someone wants out? Ambiguity breeds misunderstanding, and small disagreements quickly grow into conflict. They flare when founders have different goals and expectations about roles and rewards. Without a plan for resolving disputes, disagreements can spiral into lawsuits.

The truth is simple: goodwill is fragile, and verbal agreements do not last. Verbal agreements are easily disputed or remembered differently over time. Founders often assume goodwill will last but even long-standing relationships can falter under business pressures. Informal agreements fade, emotions start to influence decisions, and over time, trust can weaken. As the company grows and circumstances shift, the assumptions made early on can quickly become outdated. Without clear rules or a framework, clashes between founders are almost inevitable.

Starting a business without a shareholders’ agreement leaves founders exposed. Without written mechanisms, there is no clarity on voting rights, no process for breaking ties, no rules for bringing in new shareholders, and no protection if one partner becomes inactive, unreasonable, or wants to exit. Governance quickly becomes uncertain and questions about decision‑making, director appointments, or profit distribution can stall progress and create deadlocks.

Furthermore, conflicts often escalate when expectations are not aligned, and there are disagreements over control or strategy. Ownership itself can become unstable, with shares changing hands unpredictably and jeopardising the founders’ grip on the company. When disputes arise, legal remedies are limited without a formal agreement that reflects the founders’ intentions.

The “Business Pre-Nup”: Why Every Company Needs One

Think of a shareholders’ agreement as a “business pre‑nup”. Just as a prenuptial agreement defines expectations, responsibilities, and protections for spouses, a shareholders’ agreement establishes the same clarity for business founders.

When two or more people start a company, their relationship is as critical as any partnership in life. Early on, trust and goodwill feel unshakable. However, as the business grows and pressures mount, decisions over money, control, and strategic direction suddenly become high-stakes. Without any clear rules, even the strongest partnerships can encounter friction. This is why founders need a shareholders’ agreement to protect both the company and the relationship.

A shareholders’ agreement provides both legal and operational clarity. It outlines how the company should be managed, defines decision-making processes, and sets expectations for shareholder conduct. It also establishes mechanisms to resolve disputes before they escalate, ensuring fairness, transparency, and predictability.

Like a pre‑nup, it protects against worst-case scenarios. It can restrict share transfers to outsiders, safeguard minority shareholders, and complement the company’s constitution where statutory rules may fall short. It clarifies exit strategies, profit-sharing arrangements, and governance structures that evolve alongside the business.

Most importantly, it prevents conflict from undermining both the business and the relationship. By clearly defining rights, responsibilities, and decision-making, a shareholders’ agreement reduces ambiguity and provides a framework for cooperation. To sum it up, passion and trust may help to start a company, but a shareholders’ agreement will keep it running smoothly.

Conclusion: Agreement Today, Alignment Tomorrow

Starting a business without a shareholders’ agreement is like trying to build on sand. Trust and goodwill may hold things together in the early days, but cracks will eventually appear. The presence or absence of a shareholders’ agreement shapes every aspect of how a company operates.

With a well‑drafted agreement, the stability of a company is stronger. Expectations are clear, protocols are defined, and disputes are less likely to derail progress. Roles and responsibilities are clearly spelled out, profit‑sharing and ownership transfers are transparent, and decision‑making follows agreed rules. Conflict risk is reduced because there are mechanisms to resolve disagreements before they escalate.

Without an agreement, the opposite happens. Ambiguities multiply, misunderstandings persist, and disputes have no clear path to resolution. Decision‑making becomes contentious, often leading to deadlocks or power struggles. Ownership can shift unpredictably and the company will struggle to adapt to changing markets.

Even if you start a business with a friend or trusted partner, you cannot assume things will work out without a formal framework. A shareholders’ agreement is the first step to protecting both the business and the relationship. It provides clarity, fairness, and predictability, which are the foundations every successful company needs.

Stay ahead with exclusive insights! Sign up for our mailing list and never miss an article. Be the first to discover inspiring stories, valuable insights and expert tips – straight to your inbox!